Long gone are the days of three square meals. Consumers today want a diet that’s compatible with their ever-busy lifestyle and are increasingly turning to snacks.

Did you know that how we eat and think about food is changing?

Mintel’s Snacking Motivations and Attitudes 2019 report shows that 95% of American adults snack at least once a day and 70% snack more than twice a day. ‘Super snackers,’ consumers who snack more than 4x per day, is also drastically increasing with many people replacing meals with snacks.

Snackification provides a massive opportunity for retailers and consumer packaged goods (CPG) companies to connect with consumers and leverage convenience food. Join us as we explore this trend in-depth and provide actionable insights to make sure you can make the most of this trend.

What is ‘Snackification’?

Also known as grazing, eating little and often, or simply snacking, snackification is the increasing trend of replacing large meals with snacks. Instead of eating three meals throughout the day, many modern consumers are eating several smaller snacks.

Eating several snacks throughout the day often suits consumers with very busy lives. They don’t need to plan and cook a meal but can grab and go. People are also spending less time at home, which makes it harder to prepare large meals. Since snacks are available almost everywhere, they’re much easier for consumers to access or forge when they’re out and about.

Snackification Stats

- 60% of people buy snacks as part of their weekly grocery shop.

- 57% of consumers replace meals with snacks.

- 30% of consumers snack because it’s easier and 18% snack because they need to eat on the go.

- 21% of consumers snack more today than five years ago.

Snacks Sales

“Our indulgent yogurt segment, whose products offer ingredients appropriate for anytime snacking, is growing consistently vs. all other yogurt segments”

Unsurprisingly, snacks make up a large percentage of grocery sales. And, according to GEA, are also one of the fastest-growing subcategories within the packaged food market. Across the world, the snacking industry has grown by $3.4 billion with significant increases in the snack markets in Latin America, Southeast Asia and Eastern Europe.

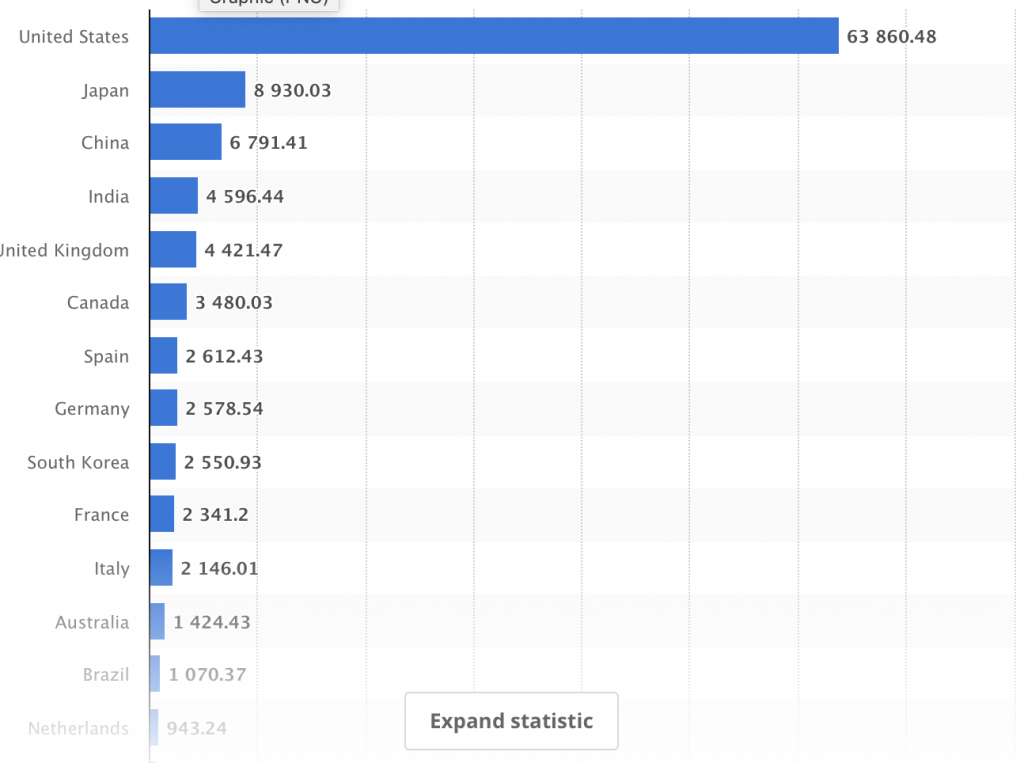

America’s snack sales continue to far outrank other nations with a total value of $63,860.48 million, while Japan has the 2nd largest snack market at $8,930.03 and the UK ranks 5th at $4,421.27.

Why is Snackification Important for Retailers?

As snackification is expected to increase as consumers’ lives become increasingly busy and complex, not jumping on the bandwagon would be a serious missed opportunity.

By increasing the availability of snacks, retailers can upsell, cross-sell and stay relevant within today’s competitive marketplace.

While carrying snacks has its challenges, especially due to changing lifestyles, staying up-to-date on the latest trends and implementing innovative marketing strategies can increase your chances of success.

Latest Snack Trends

The Snacks Expo, held every year, showcases some of the hottest products within this category and offers a fantastic way for retailers to stay up-to-date with emerging trends. So, what were the hot products at the 2019 Snack Expo?

- Health-friendly snacks. As consumers increasingly turn to snacks, they’re also demanding healthy, diet-friendly alternatives to traditional junk food. Snack companies are now producing sugar-free, ketogenic and healthy convenience food.

- International snacks. To appeal to a more global or culturally-savvy audience, retailers are also starting to carry international snacks like crispy seaweed, lotus root crisps and mung bean snacks.

- Beverage-flavoured products. Everything from pretzels to cake and chocolate is incorporating soft drink as well as alcoholic flavours like Guinness chocolate bars, Jack Daniels cakes and craft beer pretzels.

- Cheesy snacks. Health-centric consumers are gravitating towards products with fewer and fewer ingredients. Companies leveraging this trend at the 2019 Snack Expo included many snack brands with cheese-only ingredients like Air Cheese with their crunchy cheese bites.

- Funky beef jerky. Companies are taking beef jerky to a whole new level by incorporating new textures, flavours and formats like zero-sugar, South African biltong, or Hi jerky with a texture and crunch of a potato chip. Vegan, non-meat, varieties are also becoming more common.

Snacking Strategies

Chances are you probably already carry snacks, but it’s important to think about your approach. Are you carrying the right snacks? Are they priced correctly compared to their quality and value? And, how are you marketing these snacks both instore and online?

Answering these questions and evaluating your current snacking strategy can help you maximise snack sales and ensure you’re getting the best ROI.

Things to Think About

“We are looking to reduce space allocated to more traditional cheese segments, like shredded and block, to align with market trends toward snacking cheese items.”

- The right snacks. As the snack trend depends largely on lifestyle choices, it’s essential to make sure you carry the snacks consumers want. Try mixing it up by carrying junk food as well as healthier grab-and-go options.

- Price point. Examine your current price points, your competitor’s prices and those on the general market to make sure you’re finding the sweet spot. If you’re selling more upmarket snacks, you can obviously charge a higher price, but it’s important to justify this to the consumer.

- Your marketing strategy and ability to reach the right audience will influence whether you can seize the opportunities presented within the snacking trend. Think about where you place them in the store, how you reach consumers and how you position the products.

Marketing Snacks to Boost Sales

Increase Transparency & Information

As consumers become more health-conscious, grocery retailers need to support this awareness by providing more clarity and information about their snacks. Information should include not only a list of ingredients and nutritional info but also ethical considerations.

For example, consumers increasingly want information about whether products use cage-free eggs or sustainable farming methods for palm oil and cocoa.

Working with CPG companies to provide clarity around product ingredients and origins can improve brand loyalty and naturally drive sales.

E-commerce Sales

With 45% of consumers buying groceries online, snacks are evolving past impulse purchases to become a normal part of consumers’ online shopping experience. NCA data shows that consumers are increasingly buying snacks and candy through e-commerce sites with significant growth across all categories, including 61% in non-chocolate, 68% in popcorn and 46% in salty snacks.

Make sure your snack section is easy to find from your home page and are recommended to consumers, when suitable. Increasing online visibility will help online shoppers find the products they want and increase the appeal of stocking the cupboard with grab-and-go food.

Add a Personal Touch

A sophisticated customer insights platform can help you better understand your customers and the trends driving their in-store and online behaviours. These insights can reveal customer preferences; for example, whether your current customer base wants healthy or junk snacks. It can also give insights into repeat purchases, associated purchases, and help you determine if your current marketing campaigns are working.

Once you have a better understanding of your customers, you can optimise your approach and more informed, customer-focused decisions to increase sales and capitalise on the snacking trend.

This blog was written and contributed by:

Tim Collins

Managing Director

Aimia Intelligent Shopper Solutions