The retail sector has weathered its fair share of storms in recent years, from business rates to the growing influence of e-commerce. But even if retail veterans have become seasoned crisis responders, industry challenges do not always directly affect consumer behaviour. This is emphatically untrue in the case of the coronavirus pandemic.

COVID-19 has created immense structural pressures for the sector as well as significantly impacting consumer sentiment and behaviour. People are really worried about spending money, and the uncomfortable truth is that the changes which have wreaked havoc for retailers over the last few months are unlikely to abate any time soon.

New research from Alvarez & Marsal and Retail Economics, measuring the attitudes of over 6,000 consumers across six European countries, has revealed the extent to which consumer behaviour across Europe has changed, and how long this enormous shift might endure. Three key trends emerged from our research:

- Discretionary consumer spending is cratering

- The shift to online is deepening and accelerating

- Consumers now expect safety, not brand experiences

Consumer Spending: Essentials are Flying but Discretionary Purchases Have Suffered

First, the good news: some non-discretionary market segments are doing extremely well. 61% of respondents to the survey said that they had prioritised spending on essentials since the start of the pandemic. Every market surveyed reported increasing spending on food.

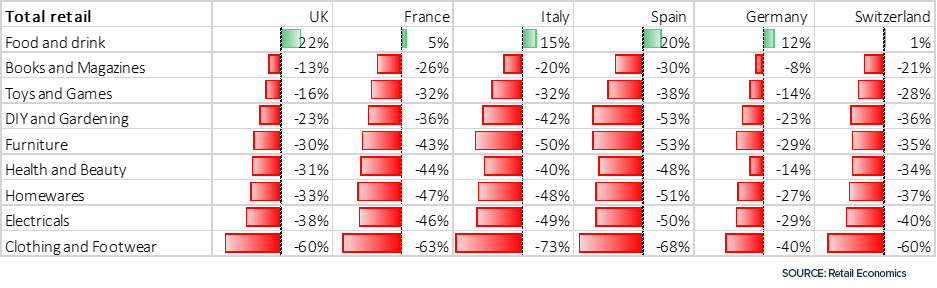

Outside food, the picture is much less rosy. Consumers are cutting back spending in every other category:

Changes in consumer spending across retail categories

The steep spending drops in categories like clothing or health and beauty paint a worrying picture. Consumers are rejecting discretionary and experiential purchases in favour of essential goods that can enhance life in lockdown. Retailers have their work cut out to understand the post-COVID consumer and adapt to changing buying habits.

Shift to Online: the European Consumer is Now Digital-first

Online is closer than ever to being the primary buying option for millions of consumers around Europe.

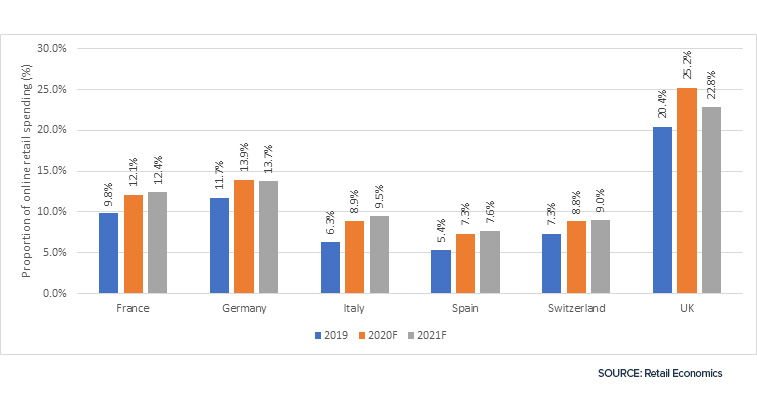

We are used to reports of consumers embracing hybrid purchasing journeys, relying on in-store experiences before hunting down deals online. This model has quickly been wiped out as ‘digital-first’ purchasing has become the norm. These changes are expected to last. Data indicates that online adoption will grow rapidly in key European markets through 2021.

Expected change in online retail spending across European markets

The economies with lower online penetration, such as Italy and Spain, stand to grow at a faster rate than those that already boast higher digital spending, like the UK. Retailers with lighter digital expertise or overweight store estates stand to be most severely impacted by this trend.

Safety Expectations: the In-store Experience has Been Turned Upside Down

Stores have begun to open their doors across Europe, but retailers have reopened to a very different world.

Consumers now expect safety and stringent adherence to government guidelines when they shop. The concept of trust has always been vital to the reputation of retailers, but ‘trust’ now concerns health and safety as much as any retail experience. The retailers that do rely on in-store purchasing need to go above and beyond to convince consumers that their stores are safe and accessible.

Retailers failing to meet these expectations risk loss of confidence from their customer base, arguably at a time when gaining trust has never been more important.

If done well, retailers could build deep and meaningful relationships with consumers, actually enhancing brand health. But this means acknowledging that customers’ priorities are different, and adjusting the marketing and brand experience to match these new expectations.

Retailers have One Shot to Transform Their Business Models

Although COVID-19 poses many severe challenges for retailers, the coming months may see unprecedented disruption. Trends that have been on the cards for years, like contactless payment adoption and the integration of data science and AI into demand planning, have accelerated in a period of weeks.

Businesses cannot hibernate for too long. With consumers urgently seeking alternatives to the old retailing model, there is a small window of time to respond to evolving retail dynamics and grab market share.

The retailers who are able to think fast and get ahead of the pack could seal their advantage through developing new products and partnerships, by investing in logistics and data in order to better understand and serve customers, or in plotting ways to better use their physical footprint.

The opportunities are potentially enormous, but retailers will have to overcome significant new obstacles in consumer demand and expectations first.

This post was written and contributed by:

Erin Brookes

Managing Director and Head of Retail, Europe

Alvarez & Marsal