According to the 2019 UNGC-Accenture CEO study, 99% of CEOs from large companies think sustainability issues are important to the future success of their business. Consumer packaged goods (CPG) companies in particular are setting their own sustainability strategies, and they also need to respond to external requests and requirements from stakeholders. Pressure also comes from employees, 86% of whom that prefer to support or work for companies that care about the same issues they do. In this post, we will look at the trends driving the sustainability agenda and compare CPG brands’ objectives for implementing sustainability standards.

The UN World Commission on Environment and Development defines sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.” Sustainability is therefore the process by which the use of resources, the direction of investments, the orientation of technological development, and institutional change consider both current and future potential to meet human needs and aspirations.

Sustainability in Ethical Commerce

The four key concepts of ethical commerce are:

- Corporate social responsibility (CSR)

- Environmental, social, and governance (ESG)

- Sustainability

- Fair trade.

The first response to business ethics was CSR, a self-regulating business model designed to be socially accountable to stakeholders. CSR often resembles philanthropy, giving to worthy causes on a large scale. Sustainability focuses on meeting the needs of the present without compromising on those of future generations. However, the term sustainability is often attributed to environmental issues. Another concept is fair trade which helps producers in developing countries receive a fair price for their products. The goals of fair trade are to reduce poverty, treat workers ethically, and promote environmentally sustainable practices; however, the term is often used to describe social, or human rights, issues. ESG is an evolution of CSR with a metrics-driven set of standards.

According to a Harvard study, companies achieve the highest stock returns when they focus on material ESG issues. ESG is not a philanthropic effort of “doing good” with leftover profits but rather a metrics-driven approach with long-term business strategies. In other words, “doing well by doing good.” Bottom line, ethical commerce is a practice that focuses on both environmental and social issues directly related to companies’ operational and financial performance.

Global production of food and consumer goods accounts for 60% of greenhouse gas (GHG) emissions, 80% of water usage, and 66% of tropical forest loss. CPG brands do their part to slow global warming by reducing GHG emissions. Reducing energy and water use and shifting to renewable resources are just a few ways to be sustainable. Ultimately, CPG brands must balance financial results and ethical commerce. Still, a lack of data, costs, advanced analytical skills, and consumer distrust are key issues for brands to overcome. As ethical commerce evolves, CPG brands must shift to a metrics-driven approach of capturing, assessing, and benchmarking their performance.

What About CPG and Sustainability?

Sourcing eco-friendly materials is an ongoing effort for both retail and CPG companies driven mainly by younger consumers. A Deloitte survey found that 45% of UK Gen-Z consumers stopped purchasing their favorite brand after discovering it was not eco-friendly.

Retail and CPG companies often generate unnecessary demand by accelerating trends and making cheap products so consumers can buy more. For example, the number of garments produced each year has doubled in the last 15 years, exceeding 100 billion. After cheap products are inevitably discarded, waste goes up and demand drops for cheap goods. Unfortunately, the ethical downside is that lowering production eliminates jobs; the garment industry in Bangladesh alone provides over 4 million jobs. Implementing quality production habits allows companies to drop pollution and provide living wages for skilled workers while also competing on quality and efficiency.

Three approaches for CPG brands to produce less waste include:

- Correctly forecasting inventory,

- Designing for the circular economy,

- Producing higher quality products.

Brands are incentivized to capture every sale possible, but once they no longer can, inventory is thrown away.

Advanced planning tools can help to optimise inventory levels while reducing waste. Augmented Reality (AR) also could reduce markdowns and waste with testing and forecasting, offering pre-orders to consumers, and reducing returns with a more accurate evaluation tool for consumers.

Production in the Circular Economy

Companies and consumers alike are shifting to another approach for sustainable production: the circular economy. Major retailer Target announced that its store brands will adapt production for the circular supply chain. For smaller operations, like digital marketplaces such as Globechain, the circular economy connects those looking to dispose and reuse their assets.

According to recent trends, consumers often have negative associations with sustainable product options, viewing them as lower quality, less aesthetically-pleasing, and most costly. If product cost increases, either the company, consumer, or both absorbs the cost. In some cases, entire categories will be less eco-friendly than others, and a company must decide if it will “do better” within the category or shift assortment strategy.

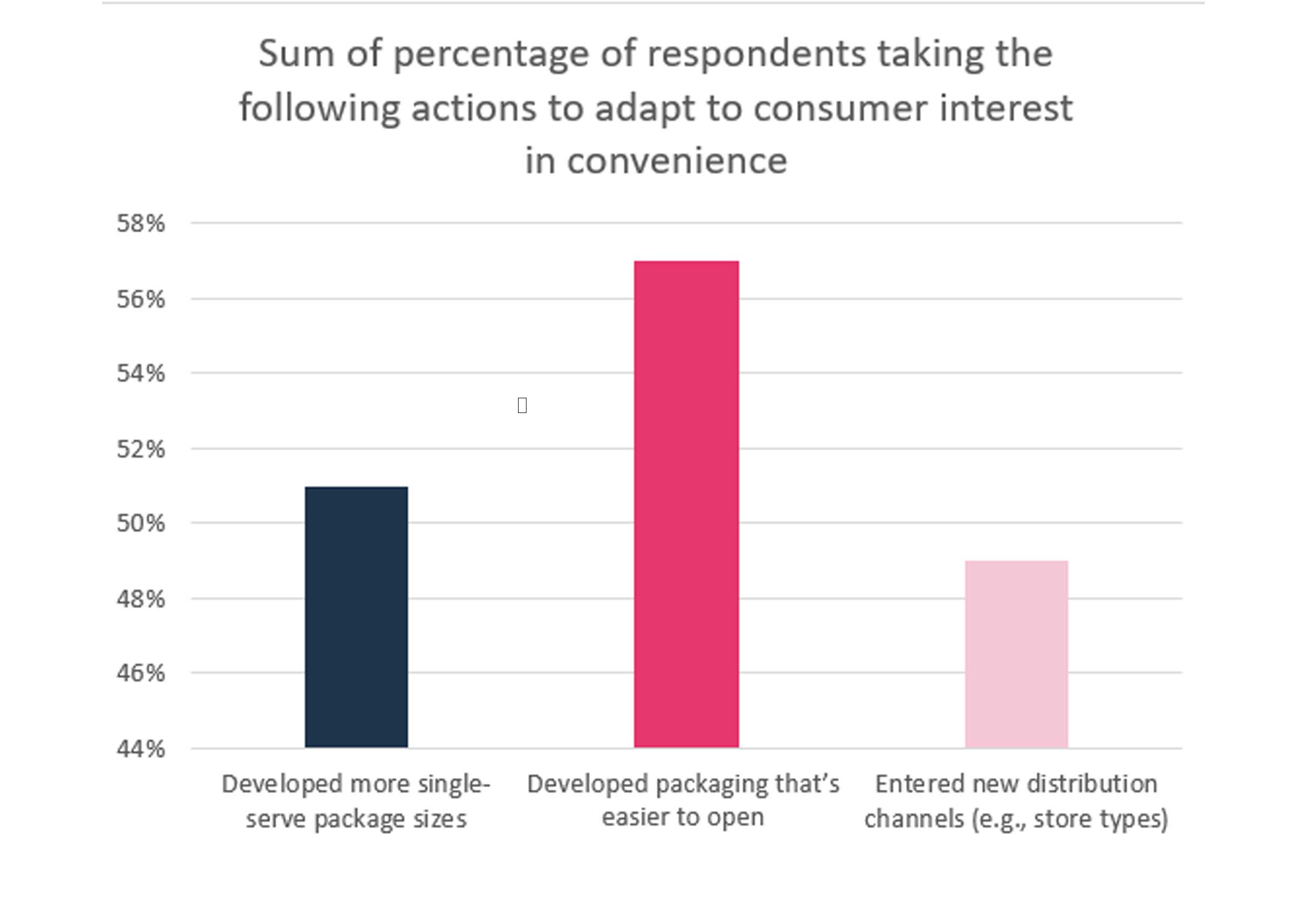

Over the last two years, two of the biggest trends in CPG has been acceleration of direct-to-consumer (DTC) and broadening the ecommerce go-to-market channel. In response, sustainable packaging has become a top customer priority. Of 250 CPG brand owners polled, 75% reported that they plan on spending more on packaging over the next year, according to a study conducted by L.E.K. Consulting. These numbers demonstrate a notable increase from 40% in 2017. Recently, CPG companies are producing easier-to-open packaging (57%), single-serve packaging (51%), and packaging with different formats to match their products’ premium contents. 25 CPG brands in particular stand out with committed sustainability objectives.

Rethinking Product Packaging

The packaging industry expects to grow by 4% each year for the next five years. And ecommerce expects to continue to grow rapidly while using seven times more boxes per dollar of retail sales than an equivalent purchase at a store. To date, 75% of all plastic ever produced has become waste, and production is expected to triple by 2050. The increased production of corrugated materials, plastic, and other packaging not only increases waste but also company costs. Predictably, multiple industry studies show that Gen Z and Millennials are pushing makers of consumer products towards sustainability practices.

Packaging is an example where, from an operations perspective, business leaders face decisions that put sustainability at odds with functionality and profitability—especially given millennial and Gen Z pressure. CPG packaging can be a complicated web of regulations. The end of a package’s life, for instance, differs from one country’s infrastructure for recycling to another. For Nestlé, which sells food products in 186 countries, these initiatives mean complying with 186 different sets of national regulations.

Customer needs also differ based on where they are shopping. Packaging online is different than in stores. Tide, for example, redesigned its detergent for online use, knowing that size and shelf-impression were irrelevant there. The designers remixed the detergent formula using a higher concentration liquid, creating a product with 60% less plastic, 30% less water, and 4 pounds less weight. On the other hand, when a natural deodorant brand did not keep shelf-impression in mind with its compressed deodorant product in-stores, consumers considered it more expensive for half the product as the competitors.

In-store retail packages are designed differently than new online products. In ecommerce, consumers experience the product at a distance through an image and reviews. Many packaging benefits are irrelevant in the ecommerce world, and they only contribute to waste, cost of goods sold, and consumer frustration when trying to open packages.

Bottom Line

A combination of operational (understanding) and analytical (acting) solutions are essential to unlock opportunities that allow a CPG brand to “do well by doing good.”