No matter how you define value, for-profit companies will continue to be measured by, well, profit. Of course, there is accounting profit and economic profit. The major difference is that accounting profit only considers tangible costs; economic profit includes opportunity costs and other intangibles. If you want to think ahead, then economic profit and the associated macroeconomic principles are more useful guides in my view.

Profitable revenue growth is a useful proxy for economic profit in Consumer Goods. In our industry, expanding profit pools through a better understanding of consumer and market trends is important. So where are the future profit pools?

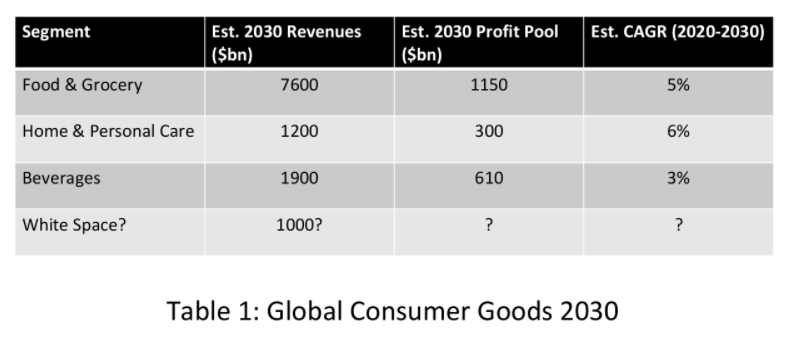

My analysis suggests that the global Consumer Goods industry could grow from around $7tn to around $11tn by 2030 (there are other predictions out there, and you should always take any forward-looking statements as “educational”). I also speculate that there is an additional potential $1tn from opportunities we could find if we are creative enough.

Let’s run with my numbers for now.

Table 1 shows my anticipation of how this might split across the major segments and the profit pools associated with each. I’ve also given a rough estimate of the Compounded Annualized Growth Rates. But what these estimates mask are the rapidly growing markets and consumer spaces, especially those where the “pool” is deeper than the revenue might suggest.

Take food and grocery as an illustration. By my estimates, portioned convenience is growing twice as fast as the rest of packaged food. Plant-based alternatives (and vegan snacking in particular) are growing at greater than 25% annually in multiple markets. Asian food is another fast-growing area as middle-class wealth continues to increase in the Asian-Pacific region (currently around 45% of global sales for Consumer Goods). The health and wellness trend continues to pick up pace.

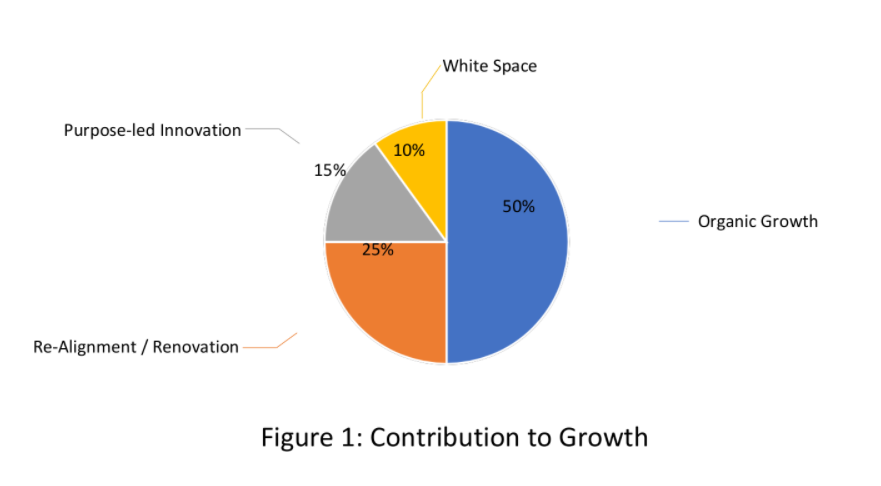

Of course, it is one thing to have consumer and market insight; it is another to turn those into profitable revenues. My assumption is that 50% of the growth this decade will be organic because of a continued rise in purchasing power in developing and emerging markets, improved distribution, and ecommerce, but where will the rest come from. And how do we find that missing extra $1tn and its profit pools?

Look at Figure 1. Changing consumer attitudes and behaviour, and new ways of looking at value creation suggest three core strategies.

First, renovate consumer and customer offerings so they align with the changing demographic, social and regulatory context. For example, apply lessons from the rapid growth of vegan snacking to expand the adjacent flexitarian market.

Second, invest in bolder purpose-driven innovations in recipes, ingredients and packaging to meet sustainability ambitions and consumer expectations profitably.

Finally, and most challenging, build trust with consumers so we can turn white-space opportunities into new market segments, categories, channels, retail formats and business models.

At a cursory glance, many smaller brands are pursuing these strategies already with marked success in monetizing white space opportunities (success sometimes meaning acquisition by an incumbent). Is their secret a magical new business model? Sometimes, but more commonly, it is finding new ways to exploit information and build intimacy with consumers and customers, and to collaborate more effectively across their entire value chain.

These smaller brands, and their leaders, understand that information gives them a competitive advantage and a route to higher levels of value creation. Surely, this is something we should all aspire to.

And, to learn more about how issues impacting the CGF members and the Consumer Goods industry at large, take a look at the Global Summit 2021.

Find out more:

Join the Open [ ] Space meetings with Dr. Trevor Davis on 3rd November 2021.