Supporting Data Exchange for Reporting and Action

Current Issues Around ESG Data Sharing

As its necessity for our transition towards sustainability is recognised, there has been a significant increase in demand for ESG data in recent years.

Reporting requirements are becoming ever more stringent, both in response to regulatory pressure and demands from shareholders and consumers for information about ESG footprints. This trend appears only set to continue as time goes on.

For firms themselves, there is a growing recognition that data is vital for effective action on corporate social responsibility commitments. There is also growing evidence that data can unlock further value in the form of efficiency and productivity gains, as well as providing valuable benchmarking and other information.

Despite this, preliminary engagement with industry stakeholders shows that there is much room for improvement in current systems of ESG data provision. In many cases useful data simply does not exist, and where it does there are high levels of friction which slow down and restrict its access and utility.

A number of sources of data friction are identifiable:

- Lack of reporting and collection capacity, particularly with respect to

- Time

- Expertise

- Technical infrastructure

- Data quality and validity issues

- Privacy concerns, especially around competitively and reputationally sensitive data

- Concerns around legal liability, both around data protection and broader ESG compliance

- High access costs, such as paywalls on key datasets

The Potential of Future Solutions

Technical solutions to many of these sources already exist. For example, by:

- Reduce security and compliance risks by enabling data to be searchable and accessed for specific, pre-defined purposes while still being stored locally by data providers, under their conditions.

- Reducing privacy risks by allowing collective data sets to be analysed, and aggregated without revealing anything about individual input data.

- Providing interoperable standards to allow and automate connection and data exchange in spite of different storage formats.

- Reducing the resources needed to verify data quality and source by allowing metadata (data about the data) to be securely encoded into shared data (also potentially reducing the additional reporting required from data sharers).

Technology can also support the remuneration of data providers, by

- Enabling secure payments to be made to data providers automatically when contractual conditions (e.g. of access or use) are met, removing the need for intermediaries.

- Reducing the costs of carrying out large numbers of low-price transactions, providing opportunities for continuous outcome-based models of remuneration which can operate at low cost for all levels of data sharing.

In short, a distributed, resourced, secure system for sharing and leveraging ESG data is possible. We have the technical tools to address the vast majority of data production and friction issues.

The Incentives Gap

One missing piece of this puzzle is incentivising actors to share their data. Incentives are simply those things which motivate actors to share data. They act on the cost-benefit calculations around data sharing, by either reducing the costs of sharing data (or increasing the costs of not sharing, in the case of regulation), or increasing the benefits of doing so.

They are important as, even if the technical possibilities to create improved ESG data sharing systems exist, stakeholders need a reason to participate in them. This is especially true if it is going to empower actors to go beyond current baselines set by compliance obligations and fulfil their highest aspirations around environmental action.

There is often thought to be a tension, however, between incentivising data production (used here to also encompass curation and sharing) and data access. Higher levels of access require access conditions, crucially including costs, to be low. On the other hand it is often these very access conditions, and in particular the ability to directly monetise data provision, which provide incentives (or reduce disincentives) to share data.

Traditional systems of paid licensing for proprietary data have traditionally been justified in terms of the incentives they create, but these also significantly reduce access due to cost and other access requirements. At the other end of the spectrum, a data commons would have a high level of access, but incentives to contribute to it are low given the free-rider problem.

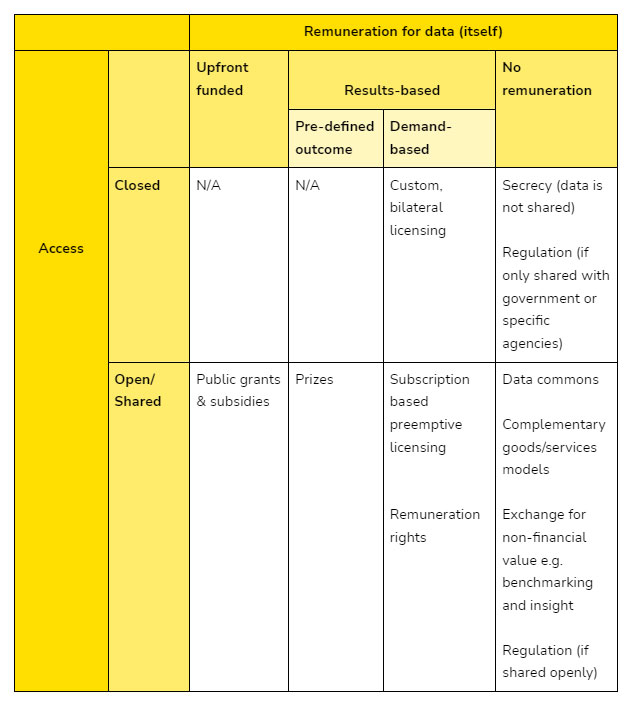

There is promising evidence that this apparent tension can be resolved, however. Given the right incentive structures, data sharing can be a win-win-win scenario: one that benefits data producers, data users, and wider society. The table below outlines a broad typology of available data production models:

This typology divides models based on whether access to the data is closed or open/shared, and how remuneration is provided such that sharing is incentivised.

The columns are further split into whether remuneration takes the form of direct, upfront funding, is not provided at all, or is provided only when certain results are met. This results based mode of remuneration can depend on discrete, pre-defined outcomes (such as passing a usage threshold) being reached – providing no remuneration prior to this threshold and no added remuneration for surpassing it further – or can track demand more continuously i.e. will continue to map demand at every level.

Discussions of how these different models of data sharing incentivisation function, and how they might be useful in supporting ESG reporting, will form the topic of our upcoming End-to-End Value Chain Open[ ]Space session.