It is undeniable how powerful the private label is becoming in almost every segment of retailing. What seemed years ago to cater to a highly price-sensitive customer segment has become a defining element of “brand positioning,” developing a brand identity in its own right, deployed to create loyalty, combining premium and economy brands covering an assortment expanded in breadth and depth and moving into new categories.

Due to structural market changes in the 1960s, retailers began to invest their surplus capital in the development of their own brands, and private labels (shop brands, retailer brands, own brand) visibly emerged in the 1980s. At that time, it ranged from versions carrying store labels to so-called “generics,” which came in bland, usually white packaging—including canned goods bearing the product identification and labeling but no brand whatsoever, on white wrappers. The recession of the late 1980s helped establish this new category. Private labels continued to thrive even as the economy recovered in the 1990s and proceeded to end the 20th century on a high growth spurt.

Today, the strategic use of private labels by retailers is diverse, responding to different commercial and brand positioning.

- Aldi dominates in private-label share for grocery, household and health and beauty products, Roughly 90% of the items in Aldi’s stores are own brands. Tesco, the pioneer of “economy own brand” in the UK and launching Tesco Value in 1993, has been quietly rationalising own-brand value range by 100 lines over three years, while the premium-tier sector has grown during the same time period. Tesco has adopted other ways to offer value prices, including its Clubcard and Aldi Price Match range as average basket size is falling as consumers leave one or two items off the shopping list to try and stretch budgets further.

- Walmart already owns four of the top five private label brands. Hema, following its farm-to-table model, is expanding cooked food and ready-to-eat meal options under its private label.

- Kroger has recently (probably influenced by the challenging inflationary context) launched Smart Way as a budget-friendly label easy to spot due to the brightly coloured signage including about 150 products.

Although some voices claim we’ve hit peak inflation, it is expected to reach 10% in the last part of the year. Economic growth is likely to fall and prices to continue to rise. Retailers—regardless of their category or target customers—are realising, sadly, that basket size and frequency of visits will be seriously affected. When value is on everyone’s mind, there is slow and steady movement in most retail markets toward increasing private label penetration to protect brand value without alienating customers. But the focus on private label is not exclusively on value choices.

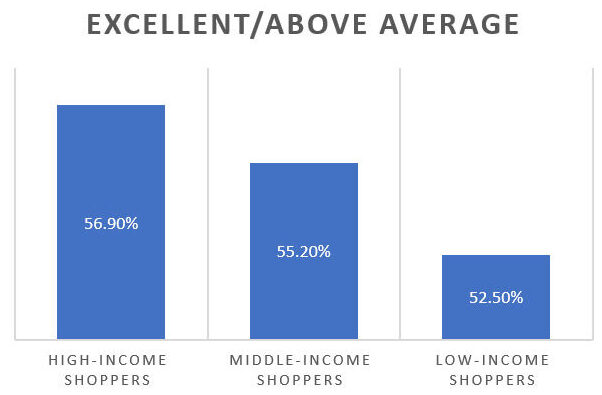

According to Numerator, high-income consumers have the most favorable opinion of private label products and more than half of them (56.9%) rate the value of private label products as excellent/above average, compared to other customer segments.

Given those numbers, the premium side of the private label assortment is an excellent weapon to reinforce loyalty among these customer segments.

This move is not new—some retailers have been increasing their private label assortments as a way to compensate for margin erosion due to increased online sales and omni-channel operations. It’s not happening evenly across the industry, either. Smaller retailers with a higher cost operating model, such as specialty and regional grocery shops, natural food shops or independent/convenience shops, may have lower gross margins on private label items than in their general category, because they are chasing low-price competition with much higher purchasing power and lower operating expenses. They will then have to price all other items effectively to compensate for this, putting further pressure on the margins of traditional brands and emerging innovations to subsidise their value items.

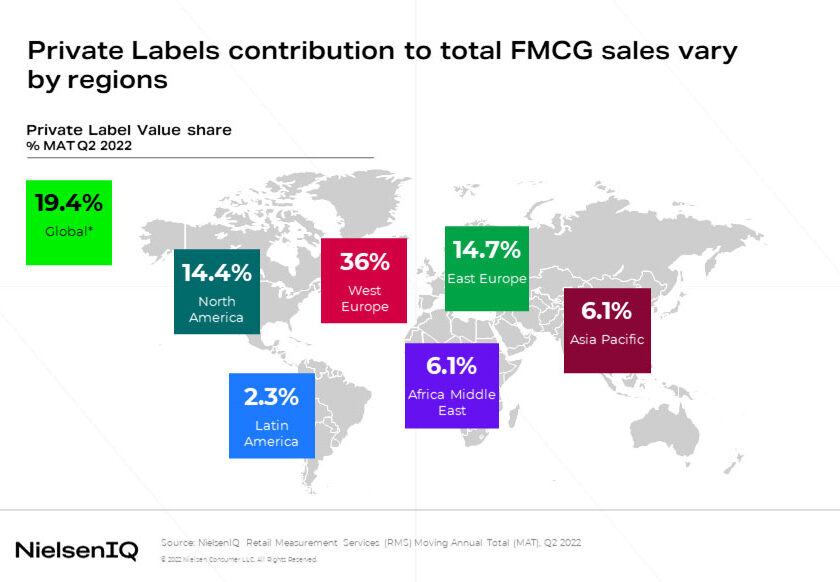

According to NielsenIQ, when looking at Q2 2022, private labels showed an increased value of sales growth at 3.5% globally compared to Q2 2021. The global number is driven by certain regions where private labels are more favored like Latin America and Eastern Europe.

Coupled with the growth of private labels and responding to the imperative need of every company in the context of rising prices to reduce costs as much as possible, there’s a growing interest in gaining efficiency in the management of private label processes. Companies are realizing synergies with the processes of branded products and simplifying the landscape of applications that support these processes, while reinforcing quality and governance capabilities. To move in this direction, a number of actions can be taken:

- Reinforce supplier focus by providing strong integration and collaboration tools to expand the data shared, reduce complexity and therefore minimize errors. Capabilities such as self-service options, automated data quality controls and AI-based product attribution, many of those already existing in the branded products context, are perfectly applicable to private label. The more integrated both set of processes are, the greater source of synergies. In many cases this is about closing the gap between existing capabilities at the service of private label vs those supporting branded products where retailers have historically invested effort as the number of SKUs were significantly higher. Today, as private label brands and SKUs and the number of marketing assets needed to compete for eyeballs online increase, private brand data management needs to reach the levels of efficiency and governance and consumer appeal of the national brands.

- Confluence with sustainability actions integrating data request coming from traceability/circularity initiatives related to suppliers, products and/or packaging information.

- Connect customer segmentation to private label development and optimization, feeding private label development processes with direct customer behaviors data to identify potential gaps, categories to develop, ingredients adjustments, etc.

- Incorporate the location and channel components in allocation decisions. Even in the most homogenous contexts, different stores and different channels experiment different customer buying patterns. Capturing and understanding those result in a more precise allocation decision maximizing the “fit” between the private label and branded products mix and the specific location customer base.

- For grocery retailers—especially during this inflation period—control the private label basic basket pricing to help customers to maintain a reasonable level of fresh products. Despite inflation being more prevalent in fresh grocery items, these items are still a primary driver of frequency. Fresh also has the highest share of basket: For every 10 items in a customer’s cart, four items are fresh (43%).

Inflation is arguably one of the most damaging elements for retailers. There are no magic formulas to fight it, but a comprehensive and collaborative private label strategy supported by data and a strong master data management capability (capture, sharing, governance, etc.) can certainly ease some of the pain.