Whether CPG companies can rely on the current state of affairs as the new normal for production planning is no longer a relevant question. Given uncertainty over the efficacy and distribution of a vaccine, any broad prediction for the next two years will likely be wrong. The key for these companies’ supply chains is to 1) work on acquiring more precise data from their deep tier suppliers (suppliers further upstream) for greater visibility and 2) find a way to support cash-strapped suppliers who cannot work at capacity to fulfill orders. In order to avoid disruption and respond to volatile demand, these are the twin objectives for supply chains during and after COVID-19, and here’s what companies have to do to get there.

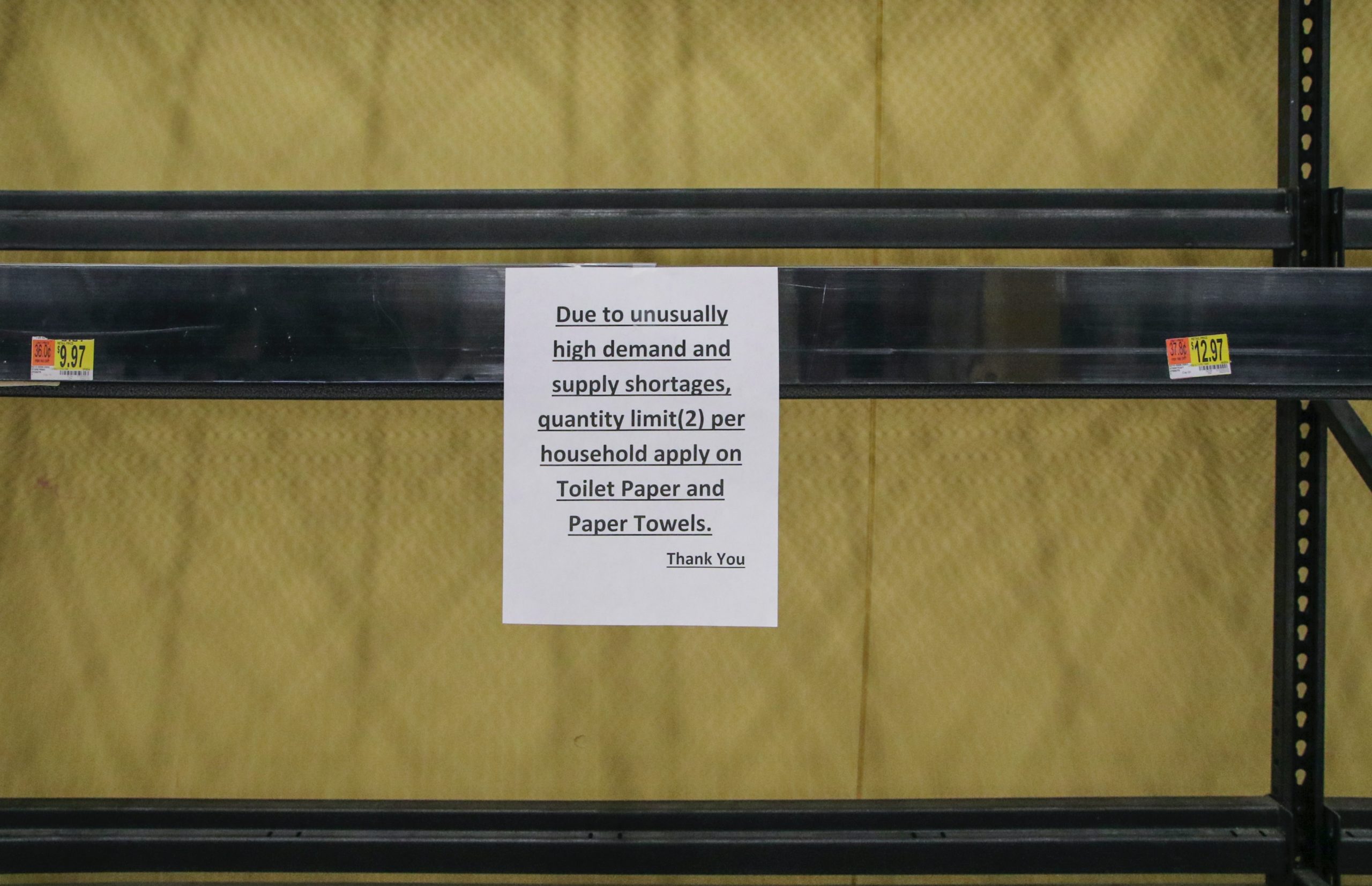

Seven months into the COVID-19 lockdown, consumers still find themselves fighting for toilet paper, disinfectant wipes and nitrile gloves at their local retail stores. On the flipside, many Consumer Packaged Goods (CPG) companies who saw a significant drop in demand at the height of the lockdown are struggling to get their production back to normal now that consumers are able to shop again.

Why do we need more precise data from the deep tier supply chain?

Over the last few years, the predominant motivation for obtaining data about the supply chain beyond the immediate, or Tier 1, supplier is to understand the origin of raw materials. That data is important for certifying compliance with certain standards, such as the organic quality of goods, and whether they were sustainably made and ethically sourced. A CPG company does not need precise real-time data from the deep tier for this purpose. A periodic audit from a third-party firm or approximations based on piecing together available data from Tier 1 suppliers and public sources is sufficient.

This data is very hard to come by. Tier 1 suppliers are fiercely protective of their sourcing and de facto role of supply chain management for an end buyer. In addition, upstream suppliers do not want to reveal their pricing or other commercially sensitive information to those further downstream in the supply chain for fear of getting financially squeezed. The difficulty is that the same documents, such as invoices, purchase orders, shipment notifications, order confirmations, etc. that can contain useful planning information for a buyer, such as ETA, quantity of goods, location, etc. also have financial data the suppliers would like to keep hidden.

Segregating this data in an auditable manner while distributing it securely across an ecosystem solves the problem, but we need cutting-edge data technology to make it possible. In addition, suppliers need an incentive to adopt any supply chain management solution, no matter how easy to use.

How can I access more data and financially support my suppliers in one go?

The answer is deep tier financing on the blockchain, which takes supply chain finance, usually only available to a Tier 1 supplier, and scales it across the value chain. Here’s how supply chain finance works: a Tier 1 supplier takes an invoice to a financial institution that works with the buyer. The financial institution will pay the supplier the amount of that invoice before the due date, taking a discount based on the interest rate applicable to the supplier. On the invoice due date, the financial institution will collect from the buyer.

Deep tier financing extends the availability of this financing model across the supply chain to suppliers further upstream. The most efficient way to get capital in a supply chain is to use the end buyer’s low interest rate to finance suppliers all the way through the value chain, resulting in significant cost savings to the supplier and a much healthier cash flow. A large global retailer has one of the most successful deep tier program to date. However, as of two years ago, 80% of this retailer’s suppliers do not participate because of complicated AML/KYC requirements with the retailer’s banks and concerns about data privacy. The remaining 20% who do participate account for 60-70% of the retailer’s volume and benefit from a closer relationship with the retailer.

What does blockchain bring to the table?

To ensure the success of deep tier financing programs, suppliers will need to be given granular control over their data privacy. For example, the banks the retailer partners with to implement its program need to see all relevant supply chain documents from the suppliers, but the retailer only needs certain fields of data to more accurately plan its orders and manage its supply chain. Blockchain does a great job of sharing data in a distributed manner while allowing the owners of that data to control exactly who sees what in a data set. In addition, blockchain can track the inventory itself in a way that is visible to multiple parties. Without inventory tracking, there is limited ability to prove that raw materials will actually go into an end buyer’s finished goods and should therefore be financed under that buyer’s deep tier financing program. Finally, the purchase orders and invoices, which contain valuable supply chain data but are also required for financing, can be turned into digital assets (not tokens) that financial institutions can freely transfer and verify to facilitate financing transactions. This last point is especially important in deep tier financing because it is likely suppliers will be receiving financing from their local banks, even if the buyer’s bank ultimately runs the program.

Therefore, the best way to get valuable data from suppliers and financially support them at the same time is to implement deep tier finance programs. Without a distributed data system that allowed for granular control of data and secure sharing of financial information across suppliers and financiers, it was impossible to build a robust program that would attract supplier participation. Blockchain solves these technical and business issues and can bring supply chains looking for change after COVID-19 disruptions some real relief.

This blog was written and contributed by:

Rebecca Liao

Co-Founder and COO